Did you know that it might take anywhere from a few days to several months on average to process an insurance claim? Both patients and healthcare providers may find this considerable fluctuation frustrating, so it’s critical to comprehend the variables affecting the time it takes to process claims.

There are multiple steps in the process from filing a claim to getting paid, and the insurance company’s processing system, the complexity of the claim, and the type of insurance can all have an impact on how quickly a claim is processed. It is possible to control expectations and make appropriate plans by being aware of the insurance reimbursement schedule.

We will examine the main elements that influence the healthcare claim reimbursement timeline and offer advice on how to use it efficiently.

Understanding the Healthcare Claim Reimbursement Timeline

In order to control expectations and minimize delays, it is crucial to comprehend the complexities of the healthcare claim reimbursement timetable. Depending on the insurance type and the regulatory regulations controlling the processing of claims, the timeline varies considerably.

Standard Processing Times for Different Insurance Types

Processing periods for medical claims differ throughout insurance companies. For example, because of government restrictions, Medicare and Medicaid claims usually follow conventional processing times, which might range from a few days to several weeks. On the other hand, due to internal policies and the intricacy of the claims filed, private insurance companies could have more inconsistent processing timeframes.

Some significant variations can be seen when examining the processing times for various insurance types in more detail:

| Insurance Type | Average Processing Time | Maximum Allowed Time |

|---|---|---|

| Medicare | 14-30 days | 45 days |

| Medicaid | 14-30 days | 45 days |

| Private Insurance | 7-60 days | Varies by state |

Legal Requirements and Timeframes for Claim Processing

The amount of time needed to process a claim is mostly determined by legal restrictions. Although this timescale might vary by state and insurance type, insurance companies are required to handle claims within a specific timeframe, typically between 30 and 45 days. Patients and healthcare professionals can navigate the system more effectively if they are aware of these legal requirements.

For instance, several states have regulations that specify how long insurance firms can take to review and pay claims. Understanding these rules might aid in organizing and overseeing the reimbursement procedure.

Factors That Affect Insurance Claim Processing Time

Timelines for medical expense reimbursement are impacted by a number of factors that affect the total processing time of insurance claims. Patients and healthcare professionals can use the system more effectively if they are aware of these factors.

Common Reasons for Claim Delays and Denials

There are a number of frequent reasons why claims may be denied or delayed. One major reason for delays is incomplete or erroneous information on the claim form. Initial rejections can be avoided by making sure all information is accurate and comprehensive.

- Absence of medical necessity

- Services that are not covered

- Inaccurate or missing patient data

It may take longer to process claims involving complicated medical procedures or diagnoses since they need to be reviewed further. Providing comprehensive paperwork to back up the claim is crucial.

How Claim Complexity Impacts Processing Duration

One important determinant of a claim’s processing time is its complexity. It takes more time and attention to examine claims that involve several operations or therapies. The turnaround time for insurance claims may be extended as a result of the need for insurance companies to confirm the medical necessity and appropriateness of the treatments.

It’s critical to file claims with all required information and supporting paperwork in order to reduce delays. By taking a proactive stance, insurance claims processing can be streamlined, which will eventually result in quicker payments.

Step-by-Step Journey of a Medical Insurance Claim

From the first filing to the last payout, a medical insurance claim goes through several stages. Understanding this procedure is essential for both patients and healthcare providers because it makes it easier to monitor the status of claims and predict when payments will be made.

From Submission to Payment: The Complete Process

The healthcare provider submits the claim to the insurance company to start the process. Either paper or electronic means can be used for this. Due to fewer errors and faster delivery, electronic claims are typically handled more quickly.

The insurance company checks the claim for completeness and correctness after it is received. In this phase, the payment amount is calculated and any required pre-approvals are checked. Important steps in this procedure include the following:

- Submission of the claim by the medical professional

- Verification of the claim’s completeness and correctness

- If required, confirmation of preapprovals

- Calculating the amount of the payout

- Processing and distributing payments

By being aware of these procedures, delays can be minimized and the healthcare payment processing schedule streamlined.

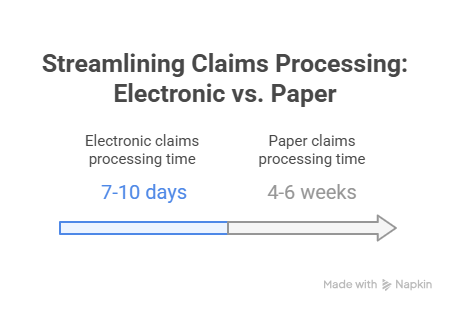

Electronic vs. Paper Claims: Timeline Differences

The efficiency of electronic claims has made them the method of choice. When compared to paper claims, they drastically cut down on the processing time. This is an analogy:

| Claim Type | Average Processing Time | Error Rate |

|---|---|---|

| Electronic Claims | 7-10 days | Low |

| Paper Claims | 4-6 weeks | Higher |

With electronic claims being processed considerably more quickly, there is a noticeable difference in processing time. This is because, in contrast to paper claims, which need to be processed manually and are more prone to delays, electronic claims are less likely to contain errors and are sent promptly.

Conclusion: Speeding Up Your Healthcare Reimbursement Process

Comprehending the healthcare claim reimbursement timeframe is essential for navigating the intricate insurance claim process. Patients and healthcare providers can expedite the reimbursement process by being aware of the legal requirements and usual processing periods.

Delays and denials can be decreased by submitting claims electronically and making sure claim forms contain proper information. Maintaining the insurance reimbursement schedule also requires following up with insurance companies.

People can increase their chances of getting prompt payment for their medical bills by putting these suggestions into practice. Healthcare providers can streamline their billing procedures by knowing the variables that impact claim processing delays, such as claim complexity.

People can efficiently manage their medical expenses by being aware of the insurance reimbursement schedule and the timing for healthcare claim reimbursement.

FAQ

What is the average processing time for a healthcare insurance claim?

Depending on the insurance type and claim complexity, the typical processing time for a medical insurance claim might vary from a few days to several weeks or even months.

How long does Medicare take to process a claim?

Although this period may change based on the particulars of the claim, Medicare normally processes claims in 30 to 45 days.

What factors can delay the processing of an insurance claim?

Lack of medical necessity, non-covered services, and incomplete or erroneous information on the claim form are common reasons why insurance claims can take longer to process.

How can I speed up the reimbursement process for my medical expenses?

The reimbursement process can be sped up by submitting electronic claims, making sure claim forms have accurate and comprehensive information, and following up with insurance companies.

What is the difference in processing time between electronic and paper claims?

Because of the lower chance of error and the faster delivery time, electronic claims are typically handled more quickly than paper claims.

Can I track the status of my insurance claim?

Yes, you can check the progress of your insurance claim by getting in touch with your insurance provider directly or, if available, through their web site.

How long does it take for a private insurance company to process a claim?

Depending on their internal policies and the intricacy of the claims, private insurance firms often handle claims within 30 to 60 days, though this might vary.

What happens if my insurance claim is denied?

You can challenge the decision if your insurance claim is rejected by submitting more details or supporting paperwork.